Archive for the ‘South Surrey Real Estate News’ Category

Tuesday, April 11th, 2023

New FVREB data shows a huge jump in sales from the previous month; however, there remains a lack of inventory. This benefits sellers, of course, and we are seeing multiple offers for many homes that are on the market. Thinking of selling? Now is a good time!

Read the full story HERE.

Read the full story HERE.

Tags: Canadian housing market, Canadian real estate, Fraser Valley, FVREB, Greater Vancouver real estate, home buyers, housing costs, housing market, RE/MAX, real estate, South Surrey, Spring market, Surrey, White Rock

Posted in South Surrey Real Estate News | Comments Off on Fraser Valley Market Trends

Wednesday, March 22nd, 2023

While the spring market is almost always a busier time of year in real estate, the past few years were more hectic than usual. Mortgage rates were at an all-time low, and there weren’t enough houses listed to satisfy the amount of buyers in the market for one.

While the spring market is almost always a busier time of year in real estate, the past few years were more hectic than usual. Mortgage rates were at an all-time low, and there weren’t enough houses listed to satisfy the amount of buyers in the market for one.

So if you put your house on the market, it wasn’t uncommon to see a line of buyers and their agents waiting for a chance to see your house, and there was a good chance your house would sell within days and for over asking price. On the other hand, buyers had to be quick to see new listings and make an aggressive offer — and they still weren’t guaranteed their offer would be chosen.

Well, as you’re probably aware of, some things have changed in the real estate market since then… yet, other things haven’t. Here are the key factors that will affect both buyers and sellers this spring:

Mortgage rates are higher. This is obviously the biggest change. We went from historically low interest, to rates that are more in line with where they tend to be historically. They’re not necessarily “high,” but they’re higher than they had been for some time, which affects how buyers feel, and how much they can actually afford to pay for a house.

Houses are taking longer to sell in some areas and price ranges. It’s not like houses aren’t selling, but it may take more time to get offers and go under contract with a buyer. It depends a lot upon your price range and area, so you might find that you can get your house sold quickly and for over asking with multiple offers still, but in some areas your house may take some time to sell and you won’t get over asking price for it. Your local agent can give you insight into which is more likely to happen with your house.

Inventory is still low. Again, this depends upon where you live and the price range you’re selling or buying in, but overall inventory hasn’t grown considerably. There are still too few houses for the number of buyers who want to buy one.

Buyer demand is still pretty high. Despite rates having gone up, there are many buyers who are glad to finally be able to look for a house and not have to contend with as many other buyers as they would have over the past few years.

Buyers are more cautious. Even though buyer demand is still high, and there aren’t that many houses to go around, buyers are being more deliberate and cautious. They won’t necessarily make offers as high as they had been, and they might not be willing to waive contingencies like a home inspection.

The Takeaway:

The spring real estate market has probably already begun (even as far back as January) to some degree in your local market, but it’s surely about to ramp up in the next few weeks with the official arrival of spring.

This spring market will probably not be quite like the past few since mortgage rates have risen, causing houses in some areas to take longer to sell. That said, inventory is still low, and buyer demand is still high.

So, if you’re planning to sell your house:

– Make sure it shows as nicely as possible.

– Price it appropriately against the competition.

– Make it easy for buyers to get in and see.

– Be flexible on your price and terms when negotiating. (Buyers may not be willing to pay the prices they were paying, or forgo contingencies as they were in the past few years).

If you’re looking to buy a house:

– Take advantage of less competition from other buyers than there was over the past couple of years.

– Don’t hesitate when you see a house you like; if you like it, someone else likely will too. Make a strong offer before anyone else does.

– Keep eye on rates and lock in your rate if it goes down a decent amount.

Tags: Canadian housing market, Canadian real estate, Fraser Valley, FVREB, Greater Vancouver real estate, home buyers, housing costs, housing market, Lower Mainland, RE/MAX, real estate, realtor, single family homes, South Surrey, Spring market, Surrey, townhouse, Trevor Miller, Vancouver, White Rock

Posted in South Surrey Real Estate News | Comments Off on Spring Market Status Update: What Buyers & Sellers Need To Know

Thursday, March 2nd, 2023

Signs of stability in Fraser Valley create opportunities for home buyers and sellers.

Housing prices in the Fraser Valley posted a slight but positive bump in February after nearly a year of month-over-month decreases. Similarly, sales, though still trending lower than normal, also recorded their first monthly gain since October.

Read the full press release and stats HERE

Tags: condos, Fraser Valley, FVREB, home buyers, housing costs, housing market, RE/MAX, real estate, realtor, single family homes, South Surrey, townhouse, Trevor Miller, White Rock

Posted in South Surrey Real Estate News | Comments Off on Latest Market Update

Tuesday, January 10th, 2023

In December, the average number of days to sell a single-family detached home in the Fraser Valley was 42 and a townhome 39 days. Condos took, on average, 33 days to sell. A year ago, properties were moving two to three times faster. That said, our market usually ticks up in January, with more listings and more buying activity.

Click HERE for details from the Fraser Valley Real Estate Board

Tags: Canadian housing market, Fraser Valley, FVREB, Greater Vancouver real estate, home buyers, housing costs, housing market, Lower Mainland, single family homes, South Surrey, Surrey, Trevor Miller, Vancouver, White Rock

Posted in South Surrey Real Estate News | Comments Off on Latest Market Update

Thursday, November 3rd, 2022

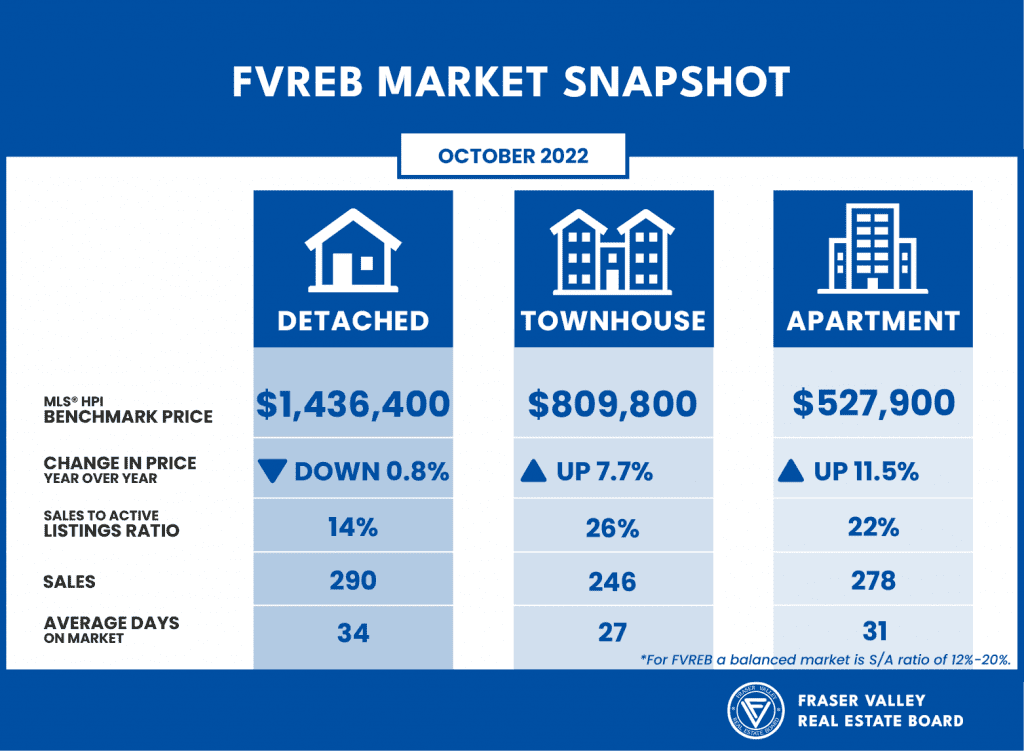

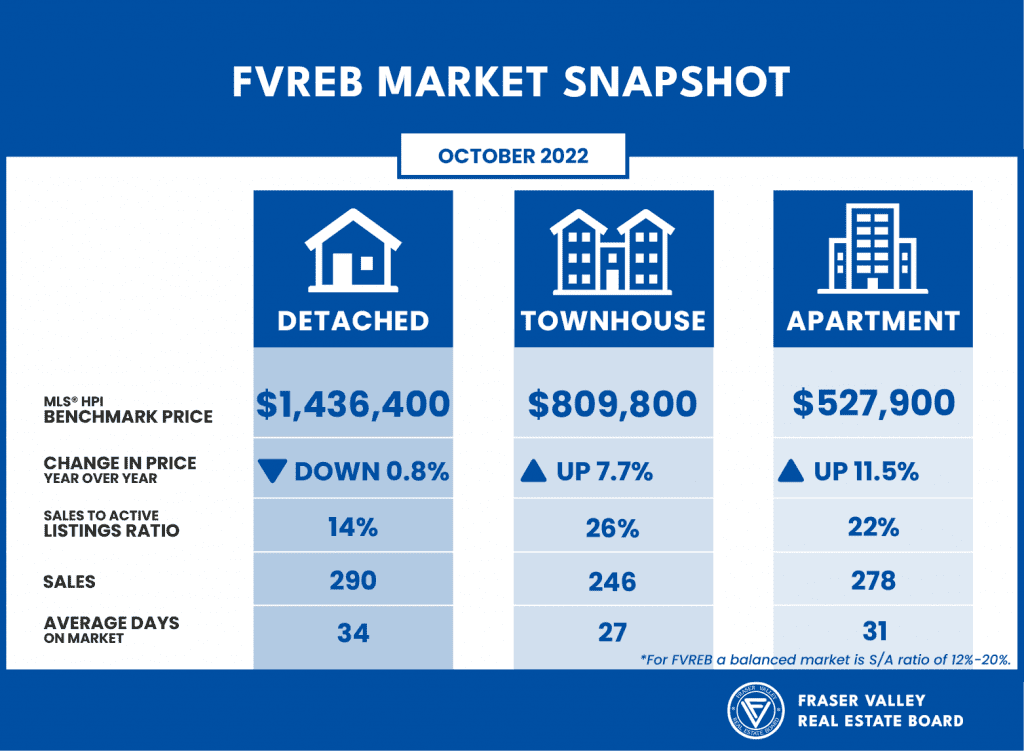

Fraser Valley housing market sales for October remained relatively unchanged from last month as prices dipped slightly across all categories.

For detached homes, prices are on par with October 2021 levels, while townhomes and apartments are up 7.7 per cent and 11.5 per cent, respectively, over 2021.

The average number of days spent on the market before selling was relatively unchanged for detached homes and apartments compared to last month (34 days and 31 days, respectively). Townhomes moved more quickly at 27 days (compared to 32 days in September).

Click HERE for full story.

Tags: Canadian housing market, Canadian real estate, Fraser Valley, FVREB, Greater Vancouver real estate, home buyers, housing costs, housing market, Lower Mainland, real estate, Surrey, Trevor Miller, White Rock

Posted in South Surrey Real Estate News | Comments Off on Housing Prices Soft, Sales Flat for Fraser Valley

Tuesday, October 4th, 2022

The latest FVREB stats out today show a continued slowing of sales and a slight rise in inventory combining to bring greater stability to the Fraser Valley housing market.

The latest FVREB stats out today show a continued slowing of sales and a slight rise in inventory combining to bring greater stability to the Fraser Valley housing market.

• Single Family Detached: At $1,462,000, the Benchmark price decreased 3.4 per cent compared to August 2022 and increased 4.1 per cent compared to September 2021.

• Townhomes: At $822,400, the Benchmark price decreased 2.3 per cent compared to August 2022 and increased 11.6 per cent compared to September 2021.

• Condos: At $530,400 the Benchmark price decreased 2.1 per cent compared to August 2022 and increased 14.5 per cent compared to September 2021

Click HERE for the full story.

Tags: Canadian housing market, Canadian real estate, Fraser Valley, FVREB, home buyers, housing costs, housing market, Langley, RE/MAX, real estate, single family homes, Surrey, townhouse, Trevor Miller, White Rock

Posted in South Surrey Real Estate News | Comments Off on More Inventory, Slower Sales Combine To Stabilize Market

Friday, September 2nd, 2022

The latest stats are out from the Fraser Valley Real Estate Board, and the average number of days to sell a single-family detached home has increased to 33. For townhomes it’s 26 days, while apartments/condos in August took, on average, 25 days to sell.

Click HERE for latest stats from Fraser Valley Real Estate Board.

Tags: Canadian housing market, Canadian real estate, Fraser Valley, FVREB, Greater Vancouver real estate, home buyers, housing costs, housing market, RE/MAX, real estate, realtor, single family homes, South Surrey, Surrey, townhouse, Trevor Miller, White Rock

Posted in South Surrey Real Estate News | Comments Off on Hot Weather, Cool Market

Thursday, August 4th, 2022

The Fraser Valley real estate market saw sales fall again in July in the face of continued interest rate hikes, as the government struggles to bring inflation under control.

The Fraser Valley real estate market saw sales fall again in July in the face of continued interest rate hikes, as the government struggles to bring inflation under control.

“It is important to keep in mind that real estate is and always will be an asset with considerable upside over the long-term,” said Fraser Valley Real Estate Board President, Sandra Benz.

“As prices come down from the highs of recent months, there are opportunities for buyers who have been waiting to re-enter the market and shop for the right property.”

View the press release & stats HERE

Tags: Canadian housing market, Fraser Valley, FVREB, home buyers, housing costs, housing market, real estate, Trevor Miller

Posted in South Surrey Real Estate News | Comments Off on Rising Interest Rates Put Brakes On Housing Market

Wednesday, May 4th, 2022

A slowing of sales combined with an increase in active listings is helping to restore a semblance of balance to the market, which is encouraging for homebuyers, says the Fraser Valley Real Estate Board.

Click HERE for the full story.

Tags: Canadian housing market, Canadian real estate, Fraser Valley, FVREB, Greater Vancouver real estate, home buyers, housing costs, housing market, Lower Mainland, RE/MAX, real estate, Surrey, Trevor Miller

Posted in South Surrey Real Estate News | Comments Off on Return To Balanced Market

Thursday, April 7th, 2022

MLS® HPI Benchmark Price Activity

Single Family Detached:

At $1,670,800, the Benchmark price for an FVREB single-family detached home increased 6.5 per cent compared to last month and increased 43.6 per cent compared to February 2021.

Townhomes:

At $840,900, the Benchmark price for an FVREB townhome increased 5.6 per cent compared to last month and increased 40.1 per cent compared to February 2021.

Apartments:

At $614,800 the Benchmark price for an FVREB apartment/condo increased 7.1 per cent compared to last month and increased 36.3 per cent compared to February 2021.

Tags: Canadian housing market, Canadian real estate, Fraser Valley, FVREB, Greater Vancouver real estate, home buyers, housing costs, RE/MAX, real estate, Surrey, Trevor Miller, White Rock

Posted in South Surrey Real Estate News | Comments Off on Fraser Valley housing supply up for third straight month

Read the full story HERE.

Read the full story HERE.

While the spring market is almost always a busier time of year in real estate, the past few years were more hectic than usual. Mortgage rates were at an all-time low, and there weren’t enough houses listed to satisfy the amount of buyers in the market for one.

While the spring market is almost always a busier time of year in real estate, the past few years were more hectic than usual. Mortgage rates were at an all-time low, and there weren’t enough houses listed to satisfy the amount of buyers in the market for one.

The latest FVREB stats out today show a continued slowing of sales and a slight rise in inventory combining to bring greater stability to the Fraser Valley housing market.

The latest FVREB stats out today show a continued slowing of sales and a slight rise in inventory combining to bring greater stability to the Fraser Valley housing market.

The Fraser Valley real estate market saw sales fall again in July in the face of continued interest rate hikes, as the government struggles to bring inflation under control.

The Fraser Valley real estate market saw sales fall again in July in the face of continued interest rate hikes, as the government struggles to bring inflation under control.