Archive for the ‘South Surrey Real Estate News’ Category

Tuesday, June 3rd, 2025

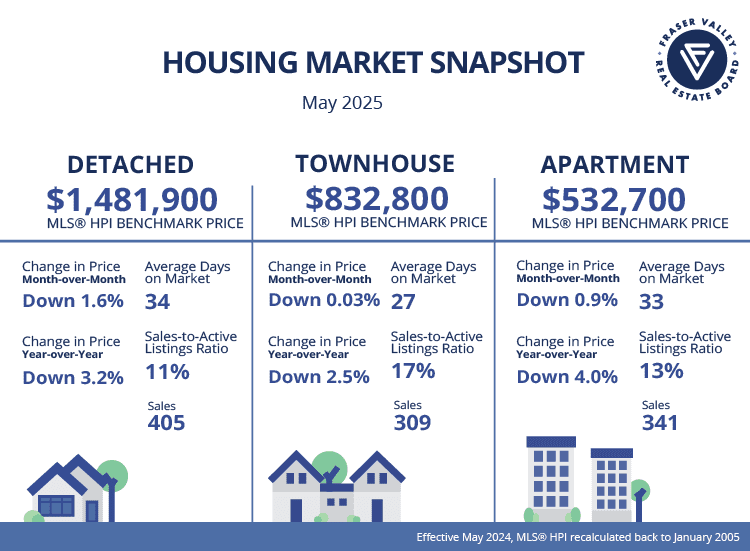

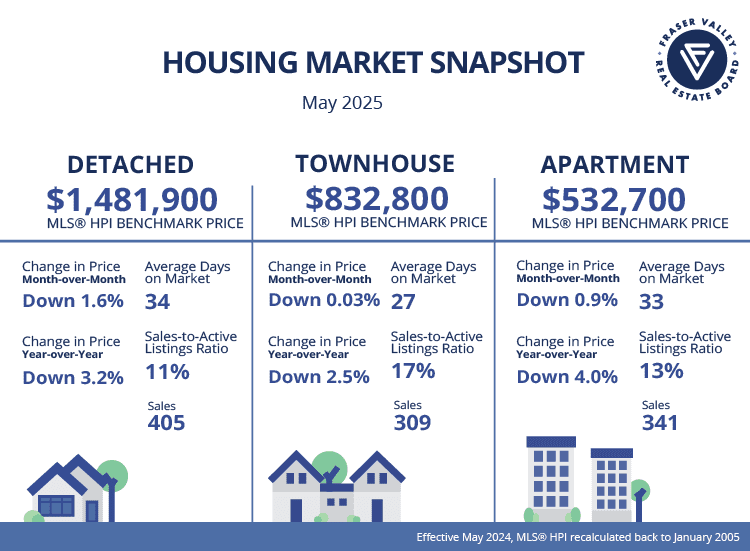

Fraser Valley remains in a buyer’s market when it comes to real estate, with a sales-to-active listings ratio of 11 per cent (12-20% is considered a “balanced market”).

“High inventory in the Fraser Valley is giving buyers more choice, but it also means sellers are facing more competition,” said Tore Jacobsen, Chair of the Fraser Valley Real Estate Board. “We’re seeing that homes priced appropriately for today’s market are selling, while sellers who aren’t in a rush are choosing to hold off or stand firm on pricing and wait for more favourable conditions.”

I can confirm this with my own experience, having just sold a 6-BR detached house in South Surrey for 98% of asking price in just 2 weeks and with just 2 open houses (more than 40 groups through!). This is because my seller clients understood the market and we priced their home accordingly — not undervalued, but fairly. So, if you’re thinking of selling, you don’t necessarily have to wait for “prices to go up”, especially if you’re planning to buy in the same market. Your competitively priced home will sell quickly. You can then take advantage of this same competitive pricing on your next property purchase!

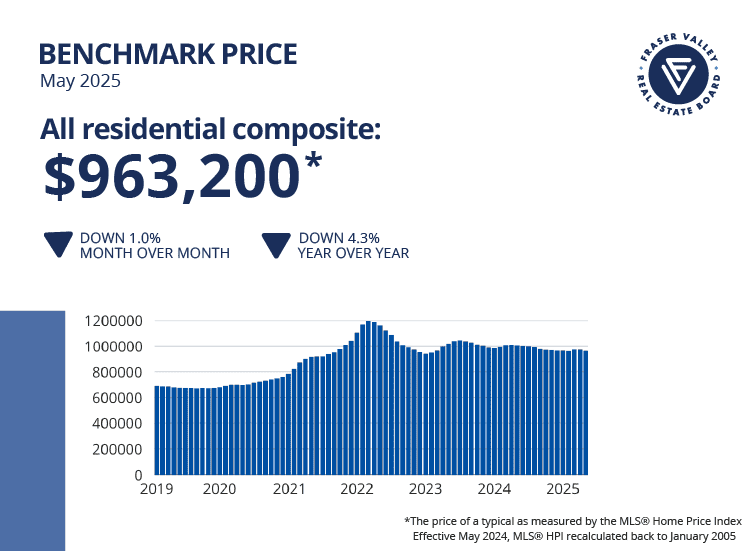

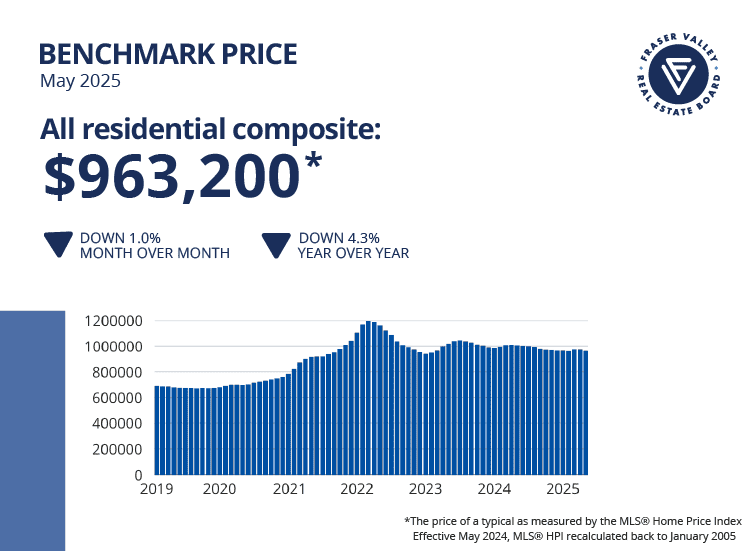

Across the Fraser Valley in May, the average number of days to sell a single-family detached home was 34, while for a condo it was 33 days. Townhomes took, on average, 27 days to sell. The average benchmark price in May was $963,200.

Posted in South Surrey Real Estate News | Comments Off on It’s A Buyer’s Market

Wednesday, March 12th, 2025

The Bank of Canada has cut its overnight lending rate by 25 basis points to 2.75 per cent, it announced today, as an ongoing trade war with the U.S. begins to strain the Canadian economy.

The Bank of Canada has cut its overnight lending rate by 25 basis points to 2.75 per cent, it announced today, as an ongoing trade war with the U.S. begins to strain the Canadian economy.

How will this new cut affect our housing market?

The hope is that by making borrowing cheaper, it will encourage more people to take out mortgages. As a result, demand for homes could rise, potentially driving up home prices. Lower rates could also benefit current homeowners looking to refinance their mortgages or purchase additional properties.

However, the actual impact will depend on other factors like consumer confidence, housing inventory, and economic conditions. If the rate cut stimulates economic growth, it could further boost the housing market.

Want to talk real estate? It’s my favourite subject, so feel free to get in touch with me!

Tags: Canadian housing market, Canadian real estate, home buyers, housing costs, housing market, RE/MAX, real estate, realtor, Trevor Miller

Posted in South Surrey Real Estate News | Comments Off on Bank Of Canada Cuts Interest Rate to 2.75%

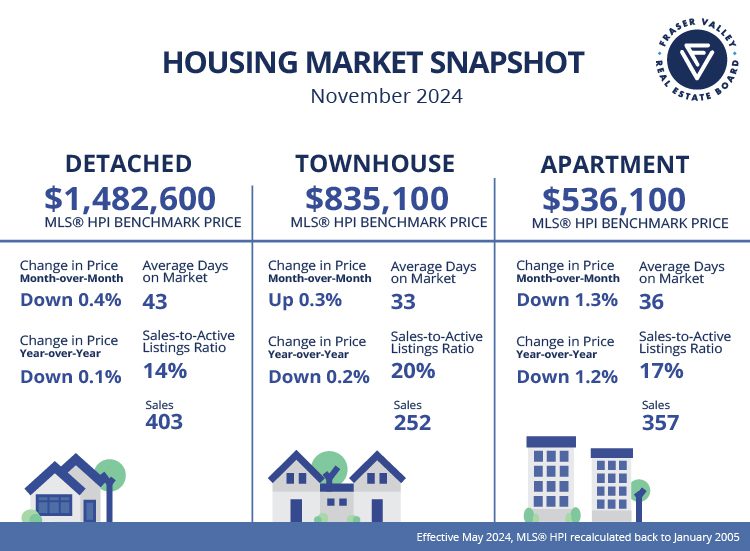

Monday, January 6th, 2025

In 2024, the Bank of Canada cut interest rates, but it didn’t really help home buyers in the Fraser Valley. They faced the lowest sales in ten years! The Fraser Valley Real Estate Board logged a whopping 35,698 new listings but only managed to sell 14,570 homes. That’s a 1% drop from 2023 and a big 24% under the 10-year average. Surrey was the star of the show, making up 51% of the sales, followed by Langley and Abbotsford. Even though prices dipped a bit, buying a home was still a tough gig. By the end of the year, the average Benchmark home price was sitting at $965,000, which was 2% lower than last year and 4% off its peak back in March.

“While the Fraser Valley saw overall balanced market conditions for most of 2024, the low levels of buying and selling activity reflected a challenging year for many as would-be buyers waited for affordability to improve,” said Baldev Gill, CEO of the Fraser Valley Real Estate Board. “Interest rate cuts by the Bank of Canada along with recent government policies aimed at boosting overall housing supply and improving affordability, should help to increase market conditions in 2025.”

Posted in South Surrey Real Estate News | Comments Off on January 2025 Market Outlook

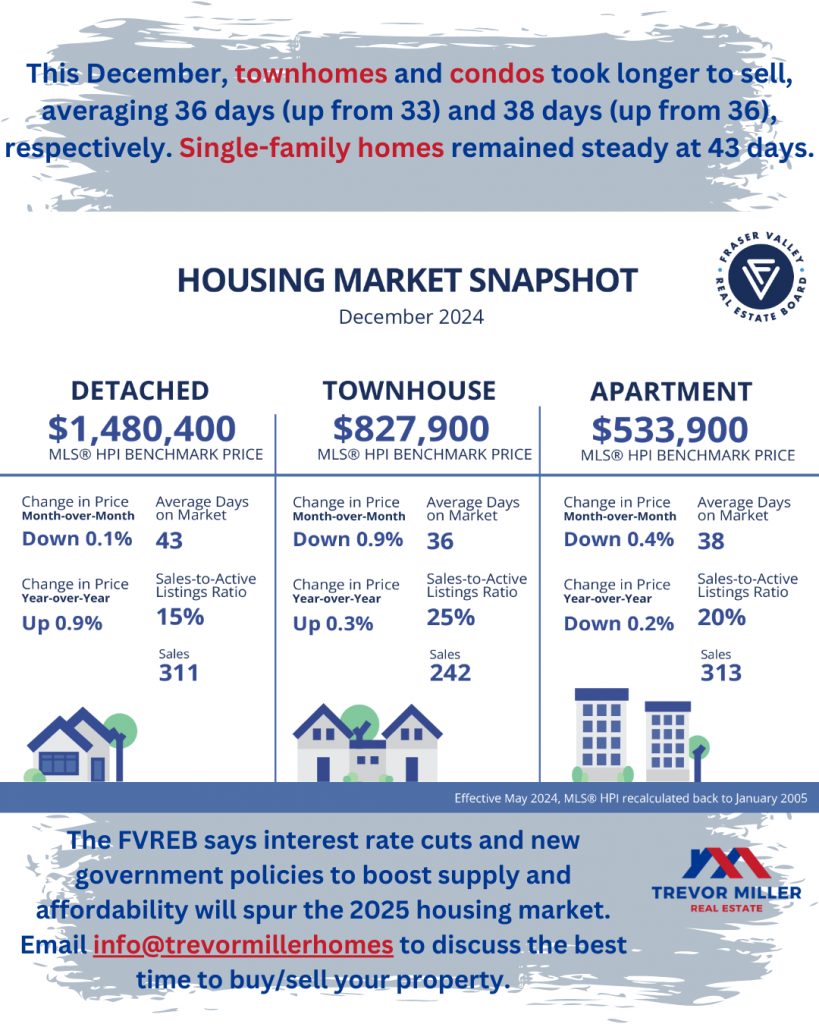

Friday, December 6th, 2024

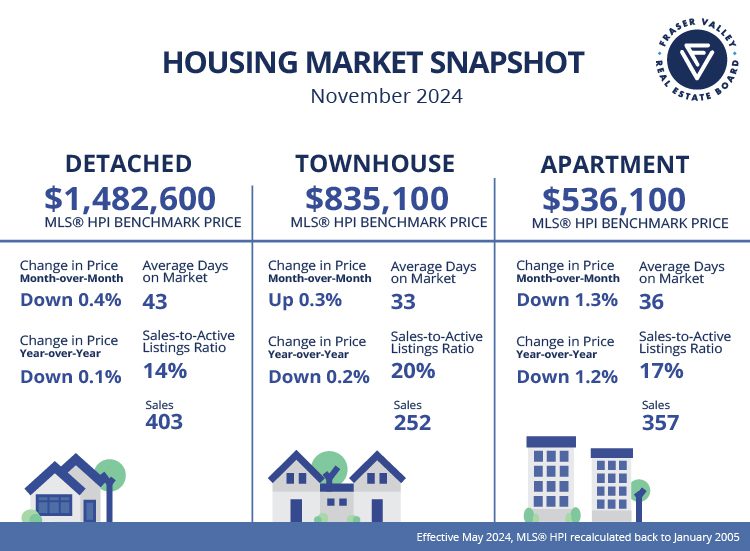

On the heels of a surge in sales in October, home sales in the Fraser Valley slowed in November with the Fraser Valley Real Estate Board recording 1,136 sales, down 15 per cent from October, but 28 per cent above November 2023 sales — “a sign that overall activity is picking up in the Fraser Valley and with it, growing buyer confidence,” according to FVREB Chair, Jeff Chadha.

A decline in new listings chipped away at overall inventory in November, with active listings declining eight per cent to 8,125. Overall inventory, however, remains at a 10-year seasonal high and 30 per cent above November 2023 levels. New listings dropped 26 per cent in November to 2,367, but remain above the 10-year seasonal average and above levels from November 2023. The Fraser Valley remains in a balanced market with a sales-to-active ratio of 14 per cent. The market is considered to be balanced when the ratio is between 12 per cent and 20 per cent.

“With seasonality expected to slow sales activity towards year-end, we are optimistic that the new mortgage lending guidelines, which come into effect on December 15, will slowly start to work their way into the market,” said FVREB CEO, Baldev Gill. “Longer amortization periods and lower minimum down payments should help more buyers who want to get into the market in 2025.”

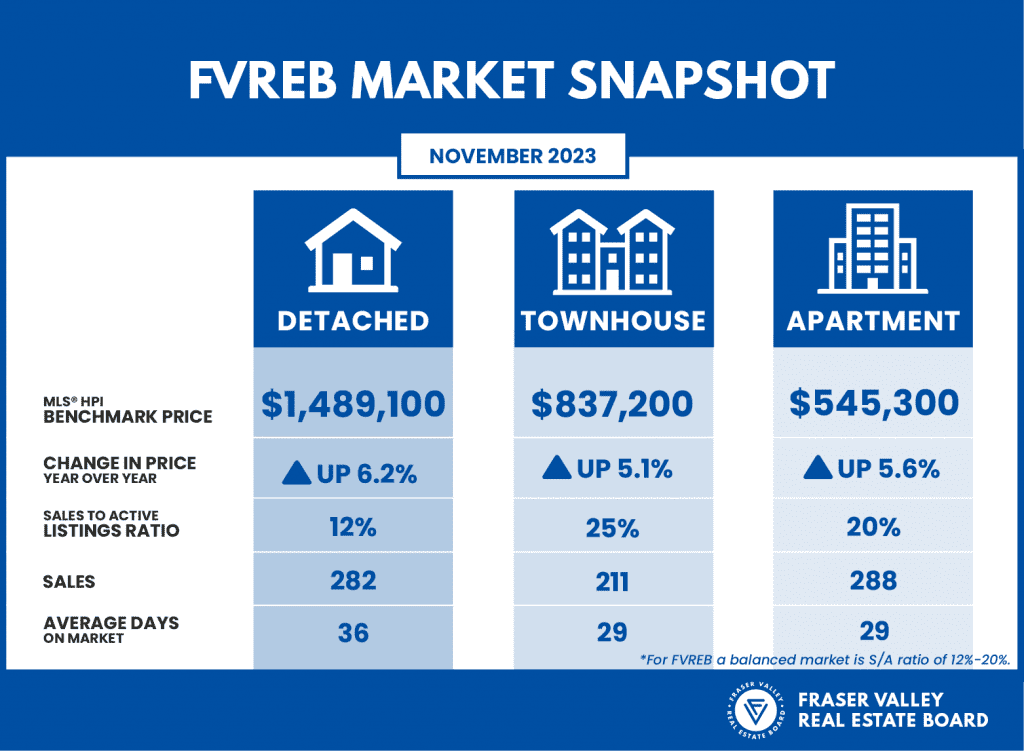

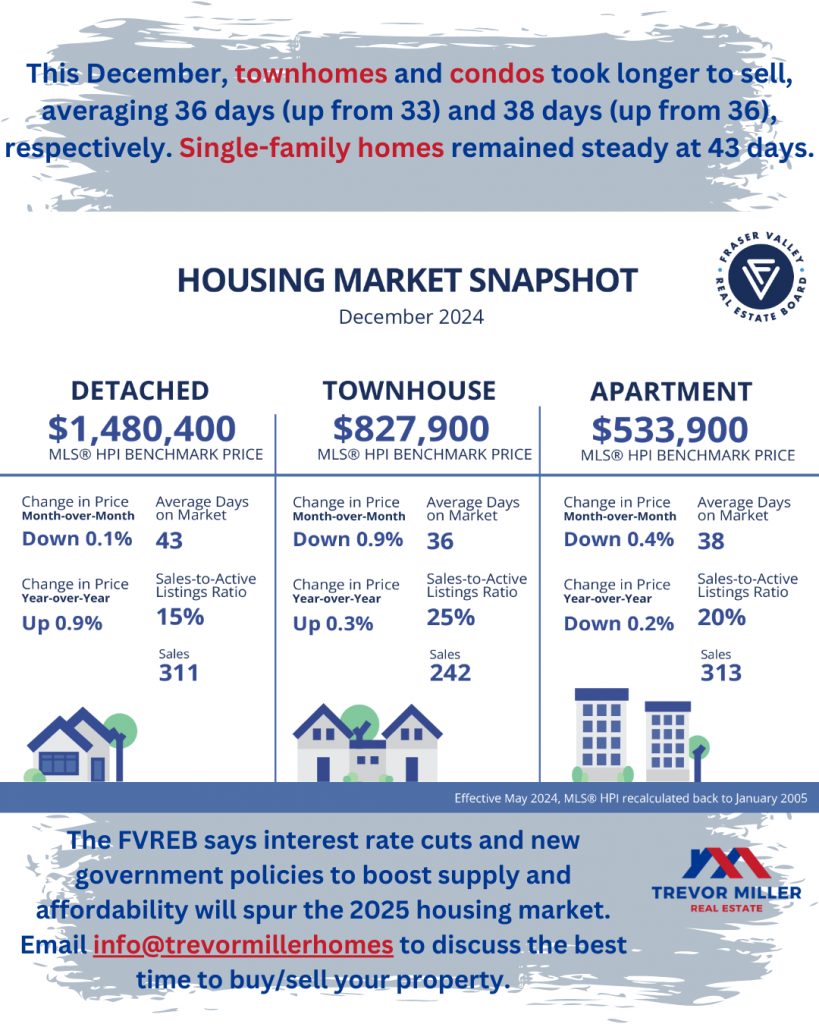

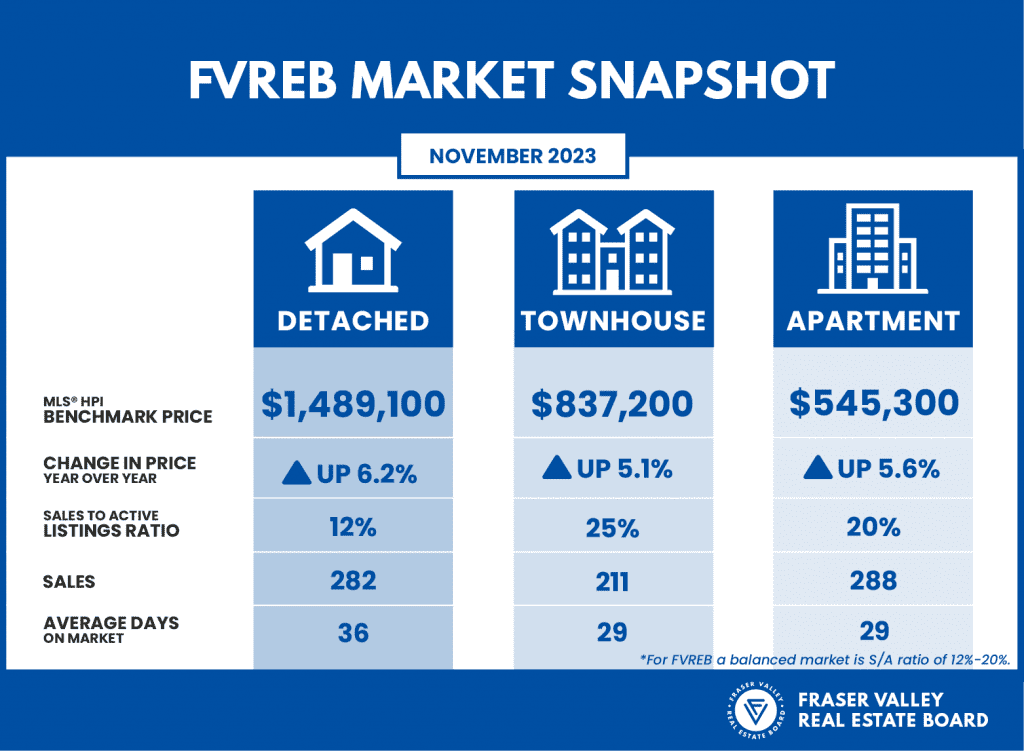

Across the Fraser Valley in November, the average number of days to sell a single-family detached home was 43, while for a condo it was 36. Townhomes took, on average, 33 days to sell. Benchmark prices in the Fraser Valley dipped for the eighth straight month in November, with the composite Benchmark price down 0.2 per cent to $969,500.

Posted in South Surrey Real Estate News | Comments Off on Housing Market Snapshot

Monday, May 6th, 2024

The BC Government’s new Short-Term Rental Accommodations Act is now in effect. As of May 1, 2024 short-term rentals are limited to a homeowner’s principal residence plus one secondary suite or accessory unit.

FAQ can be found HERE

Posted in South Surrey Real Estate News | Comments Off on Important Info for BC Homeowners!

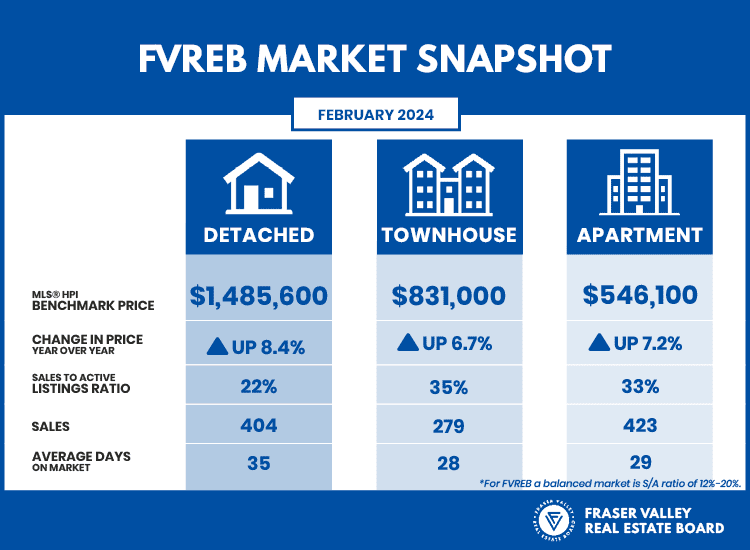

Monday, March 4th, 2024

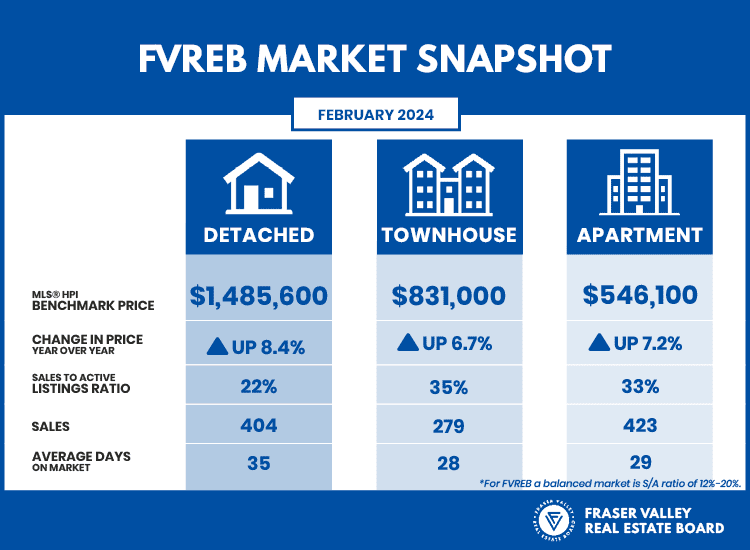

Home sales in the Fraser Valley posted a second consecutive bump last month, as new listings continue to rise and trend slightly above the 10-year seasonal average.

The Fraser Valley Real Estate Board recorded 1,235 transactions on its Multiple Listing Service® (MLS®) in February, a 32 per cent increase over January but still 21 per cent below the 10-year average for sales in the region. New listings increased to 2,797 in February, up 18 per cent from January and 4 per cent above the 10-year average.

“There is somewhat of a buzz in the market right now,” said Narinder Bains, Chair of the Fraser Valley Real Estate Board. “We are seeing new listings come onto the market and REALTORS® continue to see more traffic at open houses, however buyers are still exercising caution. We aren’t out of the woods just yet, but the signs are pointing to a further increase in activity as we head into spring.”

Active listings in February were 5,561, up by 14 per cent over last month and up by 26 per cent over February 2023. With a sales-to-active listings ratio of 22 per cent, overall market conditions are edging into a seller’s market. The market is considered balanced when the ratio is between 12 per cent and 20 per cent.

“All indications suggest we will see the Bank of Canada’s overnight rate begin to decrease mid-year, which is encouraging for buyers and sellers,” said FVREB CEO Baldev Gill. “With that confidence and the spring market on the horizon, we recommend anyone looking to buy or sell to seek the knowledge and guidance of a professional REALTOR® who can provide detailed analysis and intimate knowledge of the local market.”

The average number of days homes are spending on the market is dropping, with single-family detached homes spending 35 days on the market, down from 44 days in January, apartments spending 29 days on the market, down from 41 days in January and townhomes moving more quickly at 28 days, down from 33 days on the market in January.

After six months of decreases, overall Benchmark prices posted a slight bump in February, edging up 0.9 per cent from January and up 4.8 per cent over February 2023.

Tags: Canadian real estate, condos, Fraser Valley, FVREB, Greater Vancouver real estate, home buyers, housing costs, housing market, Langley, Lower Mainland, RE/MAX, real estate, realtor, single family homes, South Surrey, Spring market, Surrey, townhouse, Trevor Miller, Vancouver, Walnut Grove, White Rock

Posted in South Surrey Real Estate News | Comments Off on March 2024 Market Update

Friday, February 2nd, 2024

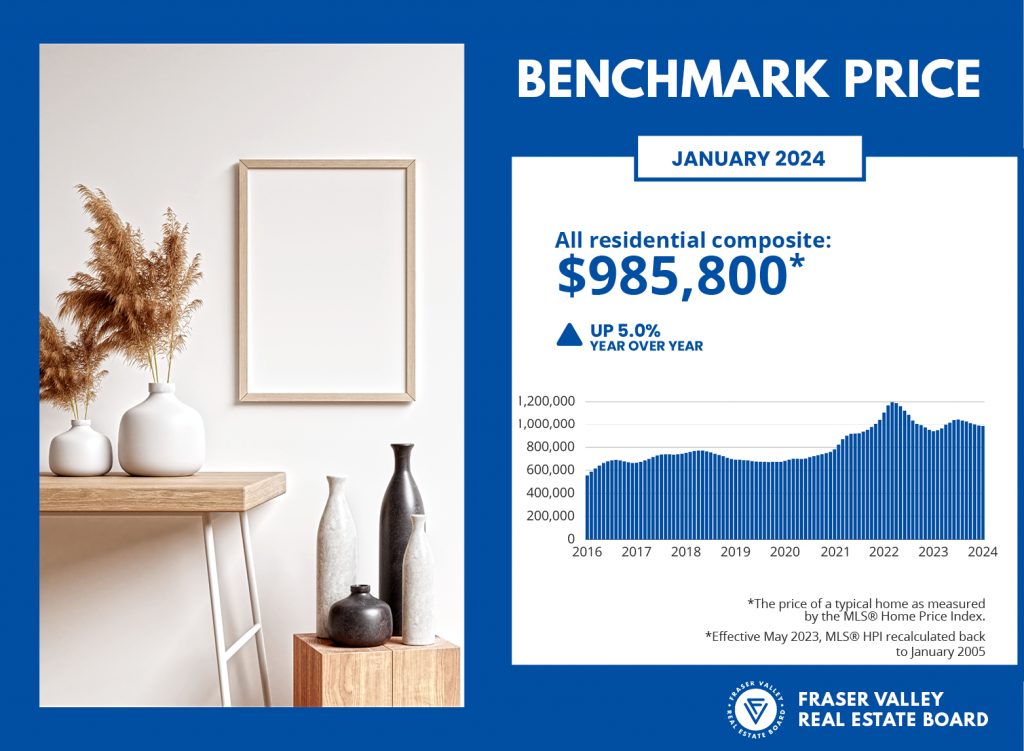

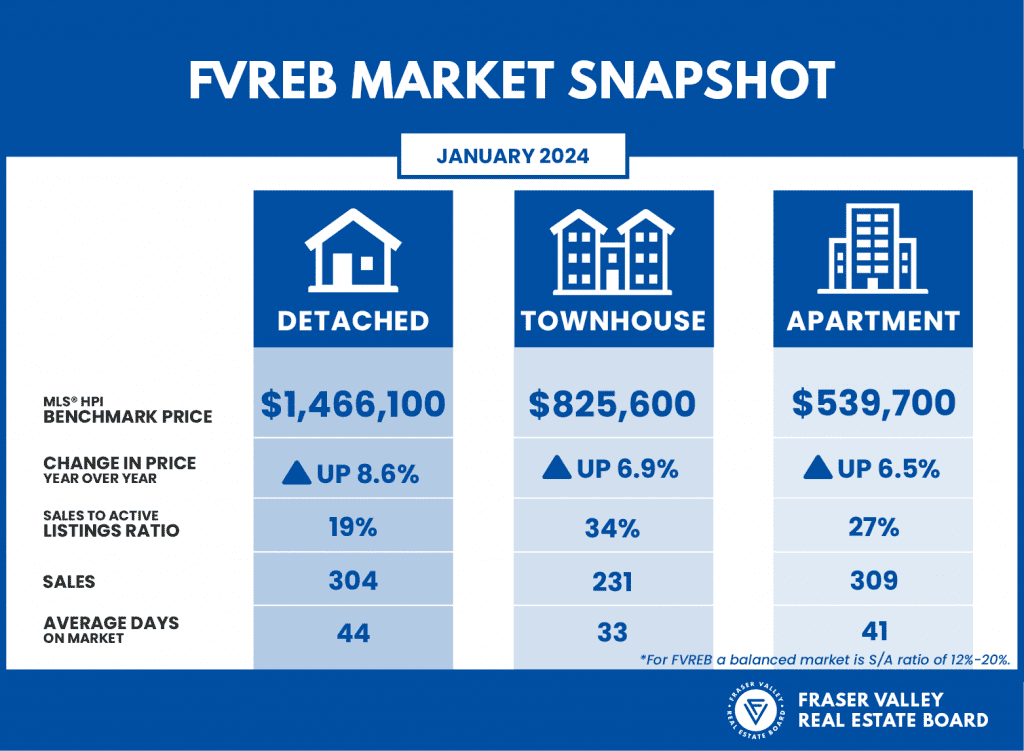

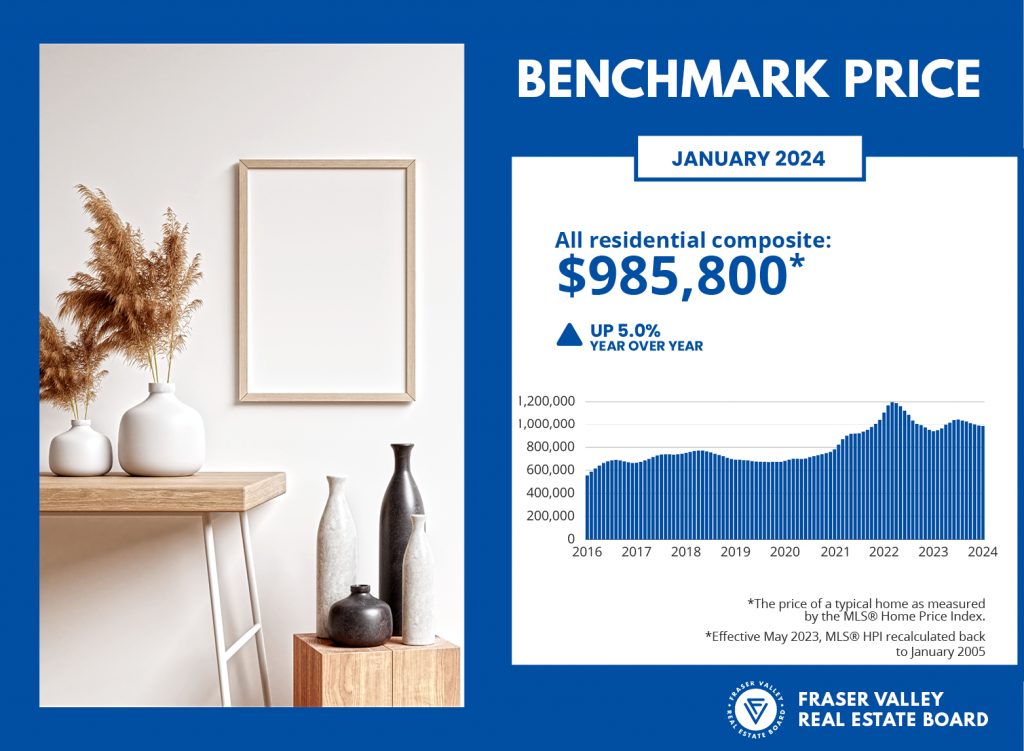

The new FVREB sales-to-active listings ratio is reported as 19%, which means a “balanced market”, while overall Benchmark prices continue to edge downward — half a per cent from December, and down six per cent from the 12-month peak in July. This is the time to get off the sidelines, before an interest rate cut sees the market (already suffering with low inventory) flooded with buyers! Feb 2,2024 FVREB Press release below:

Signs of stability in Fraser Valley housing market

SURREY, BC — The Fraser Valley real estate market showed signs of recovery in January as home sales rose after six consecutive months of decline, and new listings more than doubled.

The Fraser Valley Real Estate Board recorded 938 transactions on its Multiple Listing Service® (MLS®) in January, a 12 per cent increase over December and below the 10-year average for sales in the region. At 2,368, new listings increased 151 per cent in January, rebounding strongly from the seasonal lull seen in December. This is the largest month-over-month percentage increase in new listings in five years.

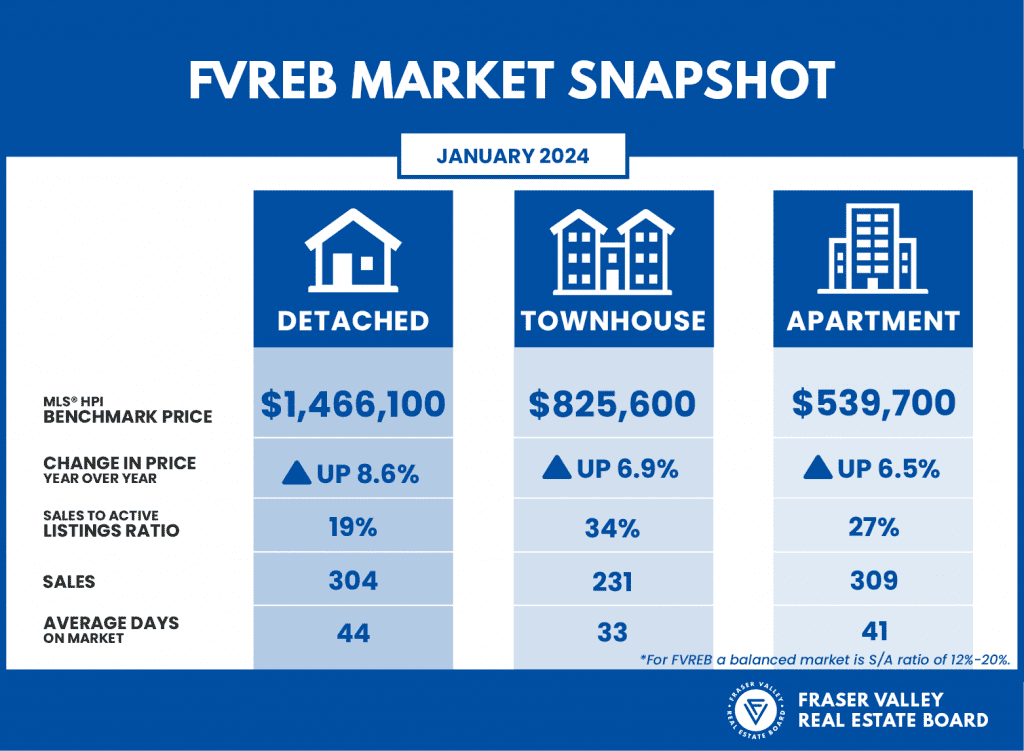

Active listings in January were 4,877, up by 4 per cent over last month and up by 18 per cent over January 2023. The sales-to-active listings ratio was 19 per cent, representing balanced conditions in the overall market. Detached houses are in balanced market territory at 19 per cent, while both townhomes and apartments remain in seller’s market territory at 34 and 27 per cent respectively. The market is considered balanced when the ratio is between 12 per cent and 20 per cent.

The average number of days homes are spending on the market has been increasing since October, with single family detached homes spending 44 days on the market, apartments spending 41 days on the market and townhomes moving more quickly at 33 days.

Overall Benchmark prices continued to edge downward for the sixth month in a row, losing less than half a per cent from December, and down six per cent from the 12-month peak in July.

Tags: Canadian housing market, Canadian real estate, condos, Fraser Valley, FVREB, Greater Vancouver real estate, home buyers, housing costs, housing market, Lower Mainland, RE/MAX, real estate, realtor, single family homes, Surrey, townhouse, Trevor Miller, White Rock

Posted in South Surrey Real Estate News | Comments Off on Feb 2024 Market Update

Monday, December 4th, 2023

The Fraser Valley Real Estate Board says sales are down 8% and listings 20% from the previous month, while buyers continue to wait on the sidelines hoping for a drop in interest rates. If/When that happens, we’ll likely see a rush of buyers competing for what little inventory is on the market, so if you’re planning to buy now could be the opportune time!

Tags: Canadian housing market, Canadian real estate, condos, Fraser Valley, FVREB, Greater Vancouver real estate, home buyers, housing costs, housing market, Langley, Lower Mainland, RE/MAX, real estate, realtor, single family homes, South Surrey, Surrey, townhouse, Trevor Miller, White Rock

Posted in South Surrey Real Estate News | Comments Off on Home sales fall for a fifth straight month

Tuesday, September 5th, 2023

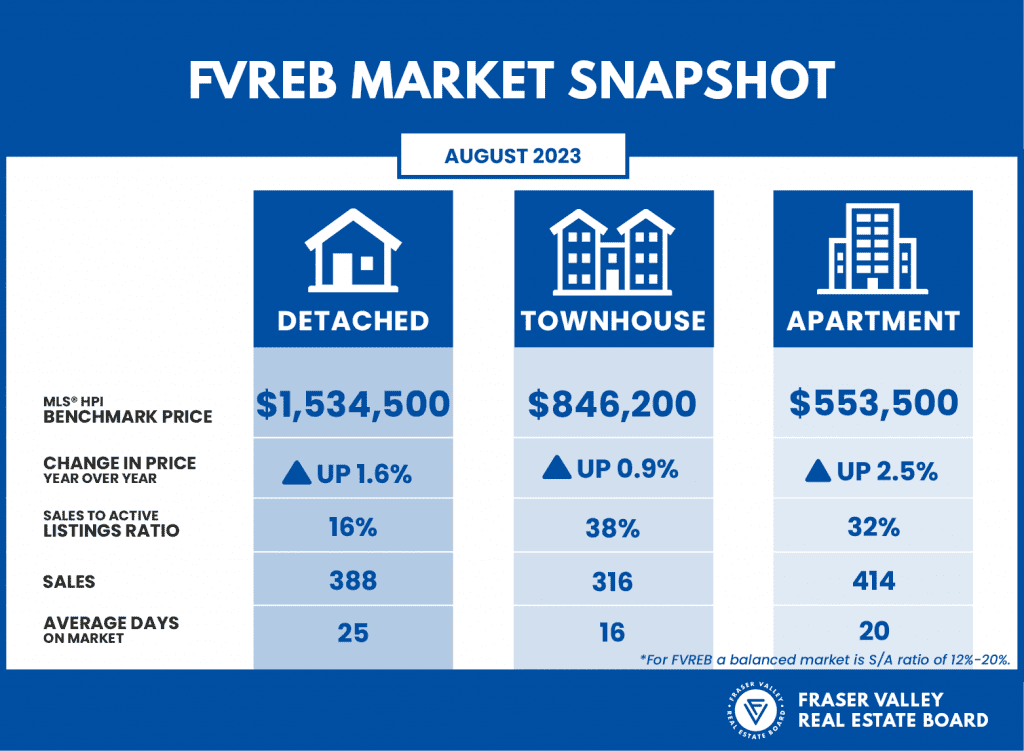

A combination of seasonal trends and cautious anticipation of the next rate announcement saw the Fraser Valley real estate market slow in August as sales fell slightly for the second month, after reaching a 15-month high in June.

The Fraser Valley Real Estate Board recorded 1,273 sales on its Multiple Listing Service (MLS®) in August 2023, a decrease of 6.9 per cent compared to July. Sales were up 25.2 per cent compared to August 2022.

New listings dropped to 2,622 in August, a decrease of 8.2 per cent over last month, but 28.2 per cent above this time last year. Active listings have been rising since last December and grew again in August by 1.5 per cent to 6,291, just 7 per cent off the ten-year average.

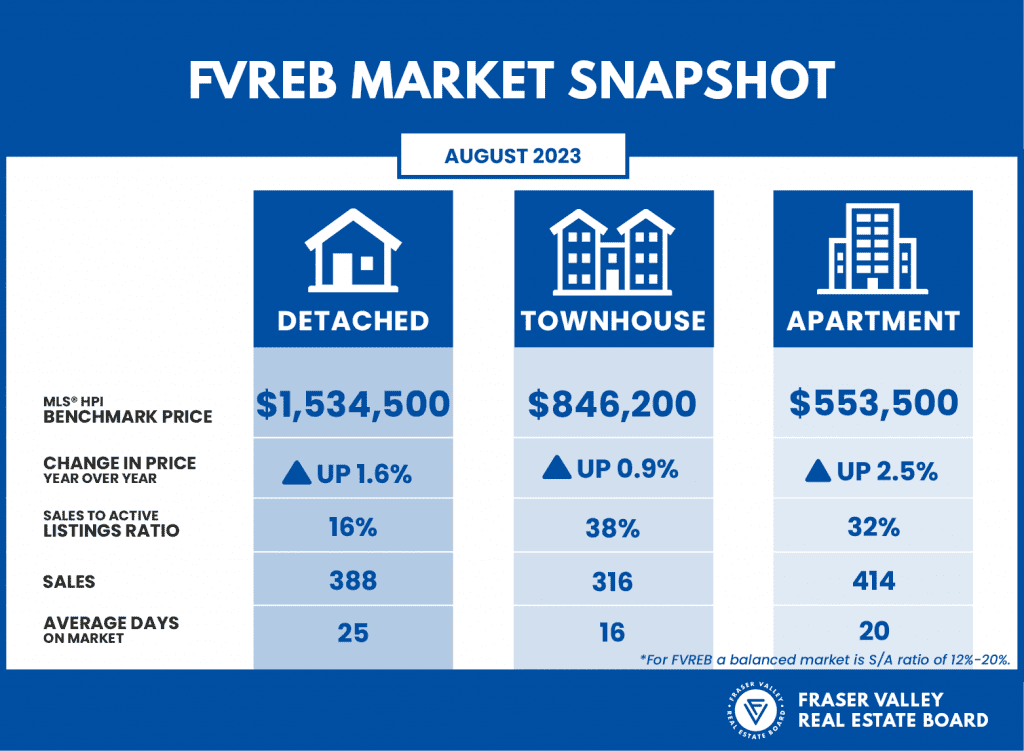

With a sales-to-active-listings ratio of 16 per cent, the market for detached homes was balanced between supply and demand. Demand for townhomes and apartments remained stronger (38 per cent and 32 per cent, respectively). The market is considered balanced when the sales-to-active-listings ratio is between 12 per cent and 20 per cent.

Benchmark prices in the Fraser Valley, remained relatively unchanged compared to last month with gains of less than one per cent across all property types. See below for details.

“We expect to see market activity pick up heading into the fall months,” said FVREB CEO, Baldev Gill. “That said, with the uncertainty surrounding interest rates as well as the potential impact of provincial housing strategy initiatives, buyers and sellers would be well-advised to consult with a professional REALTOR® to assess any risks and opportunities before making a decision.”

On average properties spent between two and four weeks on the market before selling, with townhomes and apartments moving faster (16 and 20 days, respectively) than detached homes (25 days).

Posted in South Surrey Real Estate News | Comments Off on Market dips due to interest rate uncertainty

Thursday, July 6th, 2023

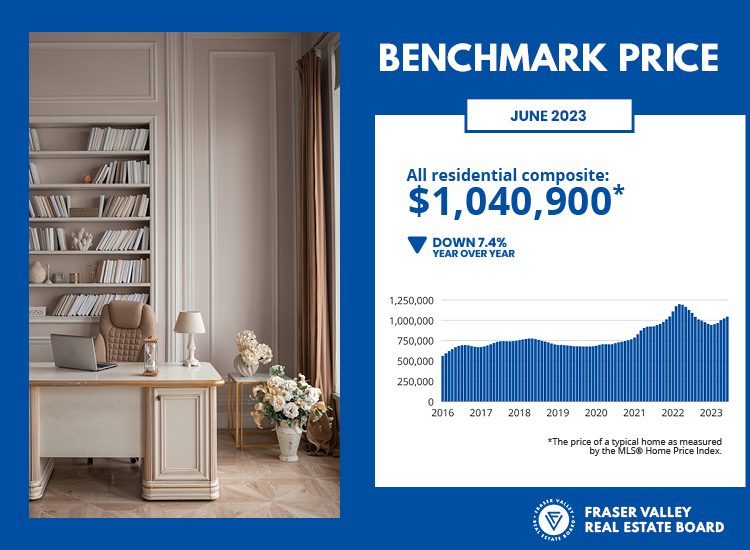

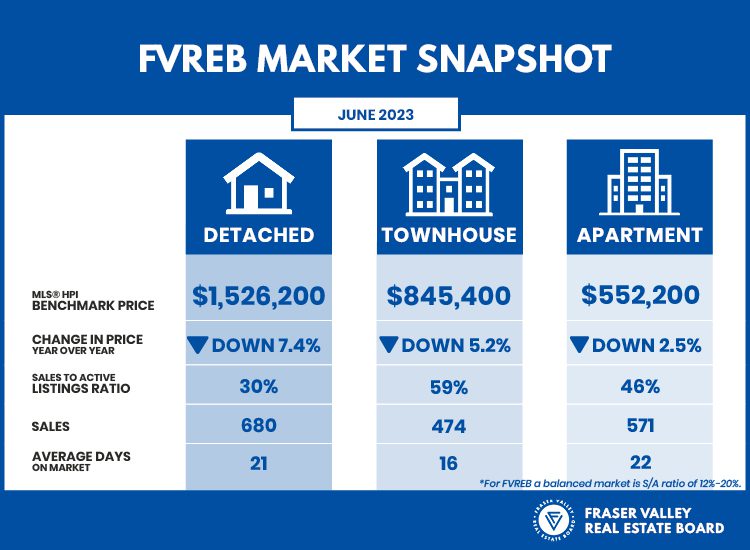

SURREY, BC – The Fraser Valley real estate market saw strong sales activity in June with levels on par with the 10-year average for the month, amid on-going challenges with supply.

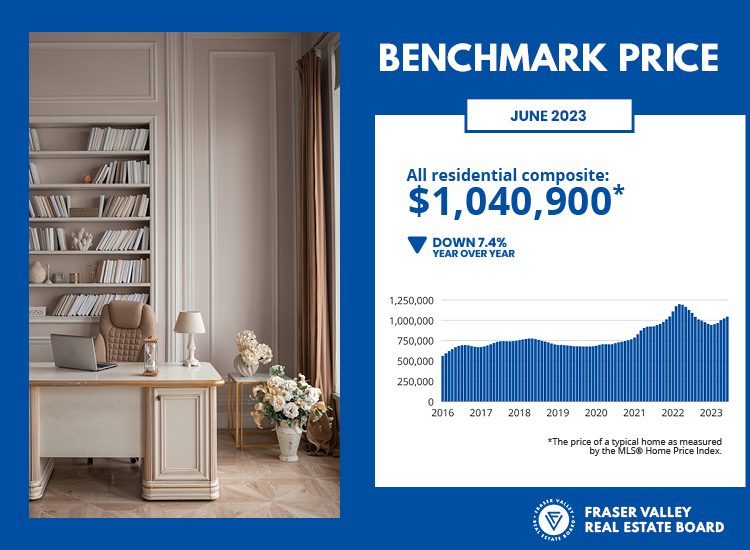

In June, the Fraser Valley Real Estate Board (FVREB) processed 1,935 sales on its Multiple Listing Service® (MLS®), an increase of 51.1 per cent compared to June 2022 and a 13.1 per cent increase compared to May.

The Board received 3,424 new listings in June, an increase of 2.8 per cent compared to last year, and a decrease of 3.1 per cent compared to May 2023. The month ended with a total active inventory of 5,944, a 6.9 per cent increase compared to May, and 8.2 per cent less than June of last year.

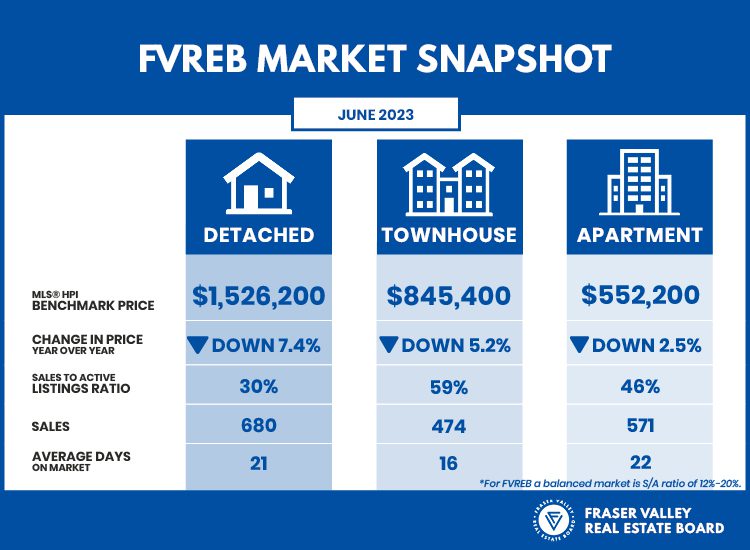

Across Fraser Valley in June, the average number of days to sell a single-family detached home was 21 and a townhome was 16 days. Apartments took, on average, 22 days to sell.

MLS® HPI Benchmark Price Activity

- Single Family Detached: At $1,526,200, the Benchmark price for an FVREB single-family detached home increased 2.3 per cent compared to May 2023 and decreased 7.4 per cent compared to June 2022.

- Townhomes: At $845,400, the Benchmark price for an FVREB townhome increased 2.3 per cent compared to May 2023 and decreased 5.2 per cent compared to June 2022.

- Apartments: At $552,200, the Benchmark price for an FVREB apartment/condo increased 1.8 per cent compared to May 2023 and decreased 2.5 per cent compared to June 2022.

Tags: condos, Fraser Valley, FVREB, Greater Vancouver real estate, home buyers, housing costs, housing market, RE/MAX, real estate, realtor, single family homes, South Surrey, Surrey, townhouse, Trevor Miller, White Rock

Posted in South Surrey Real Estate News | Comments Off on Low supply still impacting home prices: Sales increasing despite rate hikes

The Bank of Canada has cut its overnight lending rate by 25 basis points to 2.75 per cent, it announced today, as an ongoing trade war with the U.S. begins to strain the Canadian economy.

The Bank of Canada has cut its overnight lending rate by 25 basis points to 2.75 per cent, it announced today, as an ongoing trade war with the U.S. begins to strain the Canadian economy.